Plan Your Pool Budget Precisely with Our Pool Loan Calculator

Imagine lounging by your slice of paradise—a glistening pool that’s all your own. But beyond the shimmering blue waters lies the practical side: financing. That’s where our pool loan calculator steps in. This tool is your first mate in navigating the financial seas of pool ownership. Let’s set sail on the specifics of pool loans and how our calculator can steer you toward your dream pool with clarity and confidence.

Latest

How Much Value Does a Pool Add to a Virginia Home

Factors Determining The Average Pool Loan Monthly Payment

Categories

Understanding Pool Loan Interest Rates

You may wonder, “What is the interest rate on a pool loan?” It’s a crucial question as it affects your monthly payments and overall cost. Interest rates vary based on credit history, loan amount, and the lender, but with our pool loan calculator, you can input different rates and find the best fit for your budget. You’ll get a real-time glimpse of potential monthly payments, helping you to gauge what you can afford before you commit to diving in.

Demystifying Bank Pool Loans

So, what is a bank pool loan? It’s a loan specifically designed to finance your pool, offered by many financial institutions. These loans often have different qualification criteria and terms compared to general personal loans. Our loan calculator can help break down these bank-offered loans into digestible figures, simplifying your decision-making process.

Our Pool Loan Calculator

Loan Terms Explained

When you’re floating through the options, you might ask, “What is the longest term for a pool loan?” Loan terms can stretch out to make monthly payments more manageable. Some lenders may offer terms as long as 20 years, depending on the loan amount and your qualifications. With longer terms, you’ll likely pay more interest over time, but the monthly investment is smaller. Our calculator allows you to adjust the term length to find a balance between monthly payments and overall interest paid.

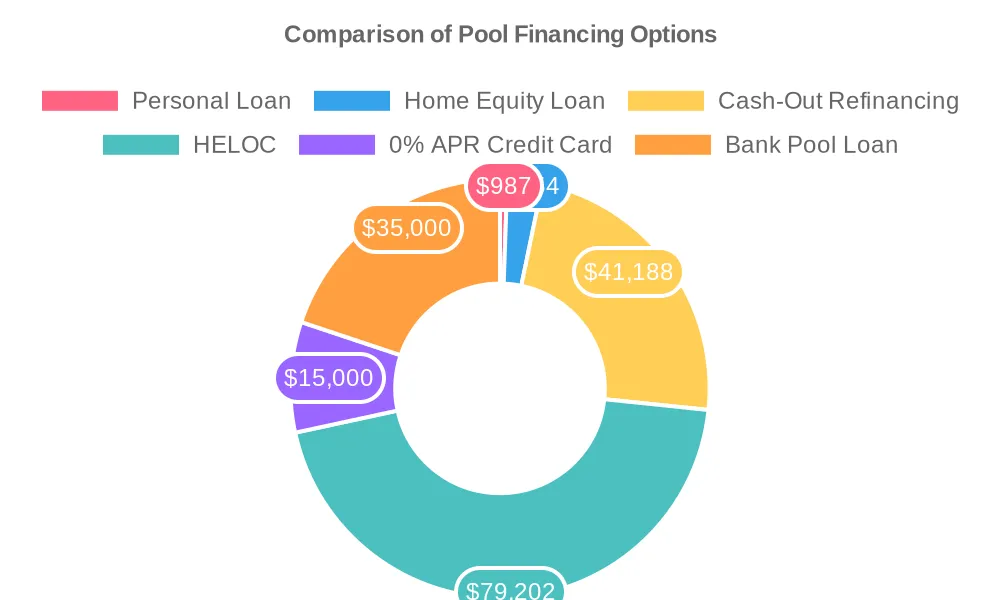

Types Of Pool Financing

Understanding the various financing paths is vital in choosing the most cost-effective method for your situation:

- Personal Loans: These unsecured loans offer quick funding without collateral, but often at higher interest rates.

- Home Equity Loans: Leveraging your home’s equity can provide lower rates, but you risk your home if you default.

- Cash-Out Refinancing: This option involves refinancing your mortgage for more than you owe and using the extra cash for your pool.

- HELOCs (Home Equity Lines of Credit): A HELOC offers flexible access to funds, using your home equity as collateral.

- 0% APR Credit Cards: If managed carefully, these cards can offer interest-free financing for a short period.

Each option comes with its own set of pros and cons. Your choice should be informed by your credit score, financial stability, and comfort with potential risks.

Calculating Loan Payments Made Simple

Tackling the question of “How to calculate loan payment?” might seem daunting, but it doesn’t have to be. With our intuitive calculator, you’ll simply enter the loan amount, term, and interest rate. The calculator then does the heavy lifting, presenting you with the monthly payments. No need for complex formulas or finance degrees—insight into your future expenses is just a few clicks away.

The cost to build a pool is as variable as the tides. Above-ground pools may gently lap at your finances, averaging between $987 to $4,754. However, for below-ground pools, prepare for a deep dive into your savings, with costs ranging from $41,188 to $79,202.

Pooling Loans: A Collective Term

In your research, you might stumble upon the term “pool of loans,” leaving you wondering, “What is a pool of loans called?” This is typically referred to in the banking world as loan securitization, where various types of loans are grouped to be sold to investors. However, when you’re focusing on financing your pool, you’re looking at a single loan tailored to your needs, which our calculator helps to demystify.

Lastly, “What is the meaning of interest pool?” In the realm of finance, an interest pool refers to the collective interest collected from a group of loans. While this concept is more relevant for investors or financial institutions, understanding how interest affects your individual pool loan is key. It determines the extra amount you’ll pay for the privilege of borrowing, and it’s an essential factor in the cost of your pool over time.

Why should you take the time to play with a pool loan calculator before making any concrete decisions? Because knowledge is power—especially financial knowledge. Here’s how using a pool loan calculator can make a difference:

- Immediate Insight: No waiting period or appointments needed. Get immediate estimates that will inform your pool project.

- Customizable Scenarios: Adjust the numbers, play with the terms, and see how different down payments affect your monthly commitment.

- Empowered Decision-Making: With clear figures, you can make decisions that prevent overextending your finances and ensure you enjoy your pool worry-free.

PoolForce invites You to Calculate and Create

We invite you to dive into our pool loan calculator. It’s more than just a tool—it’s your gateway to understanding the full spectrum of pool ownership. Take a moment to enter your projected costs, tweak the variables, and watch as the calculator unveils a world of possibilities. Each number, each scenario, brings you closer to the backyard transformation you’ve been dreaming of, backed by a plan that’s built to float.

Once you’ve dipped your toes into the potential of your project with our pool loan calculator, we encourage you to browse through our financing options. Each plan is crafted to provide flexibility and peace of mind, ensuring that when you’re ready to take the plunge, you’re supported every step of the way. With our comprehensive approach and commitment to excellence, PoolForce is dedicated to helping you achieve the backyard retreat you’ve always envisioned.

Latest

What Will Influence Infinity Swimming Pool 2024 Prices

How Much Value Does a Pool Add to a Virginia Home

Factors Determining The Average Pool Loan Monthly Payment

Categories

YOU'RE NOT IN THIS ALONE

We are with you every splash of the way

Need a pool fix or looking for an upgrade? We’re just one click away to help with all your pool needs.